Selling your rental property is a significant decision, one that requires careful thought, planning, and strategy. Many property owners wonder if there is a “right time” to sell their rental property. The truth is, there isn’t a one-size-fits-all answer. The best times to sell a rental property vary depending on several factors such as market conditions, personal financial goals, and the potential pitfalls of selling a rental property. In this blog, we’ll explore the key factors to consider when deciding the best time to sell and how to maximize the benefits of this potentially lucrative decision.

Understanding Market Conditions

The real estate market plays a crucial role in determining whether it’s the right time to sell your rental property. As with any investment, timing is everything. Generally, the market is divided into two categories: a seller’s market and a buyer’s market. In a seller’s market, demand for properties exceeds supply, leading to higher prices and quicker sales. On the other hand, in a buyer’s market, there are more properties available than buyers, which often leads to lower prices and longer time on the market.

The best time to sell a rental property is typically when it’s a seller’s market, which can maximize your return on investment. Seller’s markets tend to occur when interest rates are low, and economic conditions are strong, encouraging people to buy. However, these conditions are not always predictable. Thus, property owners need to monitor local market trends and forecasts regularly to determine if now is the right time to sell.

Another factor to consider is the time of year. The housing market generally sees an uptick in activity during the spring and summer months. Families often prefer to move during the warmer months, making it easier to attract buyers. Conversely, the winter months can be slower, with fewer buyers and less competition, but this could also mean less competition from other sellers, providing an opportunity to stand out in a less crowded market.

Evaluating Your Financial Goals and Personal Situation

Beyond market conditions, your personal financial situation plays a significant role in determining whether it’s the right time to sell your rental property. When deciding to sell, it’s essential to assess your current and future financial goals. Are you looking to free up capital for another investment? Or perhaps you’re planning to downsize, reduce debt, or diversify your portfolio? Selling your rental property could provide the liquidity you need to pursue these goals.

Consider the long-term financial implications as well. Are you prepared for potential capital gains taxes? Depending on how long you’ve owned the property and your tax bracket, you may be subject to capital gains tax on the profit from the sale. However, there are strategies like the 1031 exchange that can help defer taxes if you reinvest in another property, so it’s worth consulting with a financial advisor to understand the potential tax consequences before selling.

Another important consideration is the cash flow from your rental property. If you are still generating a steady income from the rental, it may be worth holding onto the property for a longer period to continue benefiting from the rental income. However, if the property is no longer providing sufficient cash flow, or if maintenance and management costs are outweighing the income, it may be time to sell.

Finally, consider your personal circumstances. If managing the property has become too time-consuming, stressful, or costly, selling may allow you to regain peace of mind. On the other hand, if you have the time, resources, and interest in managing a rental property, holding on to it could continue to generate passive income in the long run.

The Risks and Pitfalls of Selling a Rental Property

Selling a rental property can be a profitable venture, but it’s important to be aware of the potential pitfalls that could arise throughout the process. One of the most significant risks is the possibility of not getting the price you want. In a slower market or during an off-peak season, it may take longer to sell your property, and you may have to lower the asking price to attract buyers. Additionally, if your property is in need of significant repairs or updates, it may be challenging to secure a good offer.

Another risk is the potential loss of steady rental income. If you sell your rental property, you are no longer able to generate monthly rental payments, which can be a source of reliable cash flow. It’s important to weigh the benefits of selling now versus holding on for future growth or rental income. If you sell, you’ll need to consider how you’ll replace that income, whether by investing the proceeds into other income-generating assets or taking on a new investment opportunity.

There are also the logistical challenges of selling a rental property with tenants in place. If your property is occupied, you’ll need to navigate the complexities of showing the property to potential buyers without disrupting the tenants’ daily lives. In some cases, tenants may have lease agreements that require advance notice of your intent to sell, which can make the selling process more time-consuming and complicated. It’s important to communicate with tenants early on and ensure they are aware of the situation, as this can help avoid misunderstandings or conflicts.

Finally, there’s the emotional aspect of selling a property that you’ve invested time, effort, and money into. Letting go of a rental property can be an emotional decision, especially if it has been a long-term investment. It’s essential to approach the sale from a business perspective and not let emotions cloud your judgment. If you decide to sell, try to keep focused on your long-term financial goals rather than any personal attachments to the property.

Preparing for the Sale

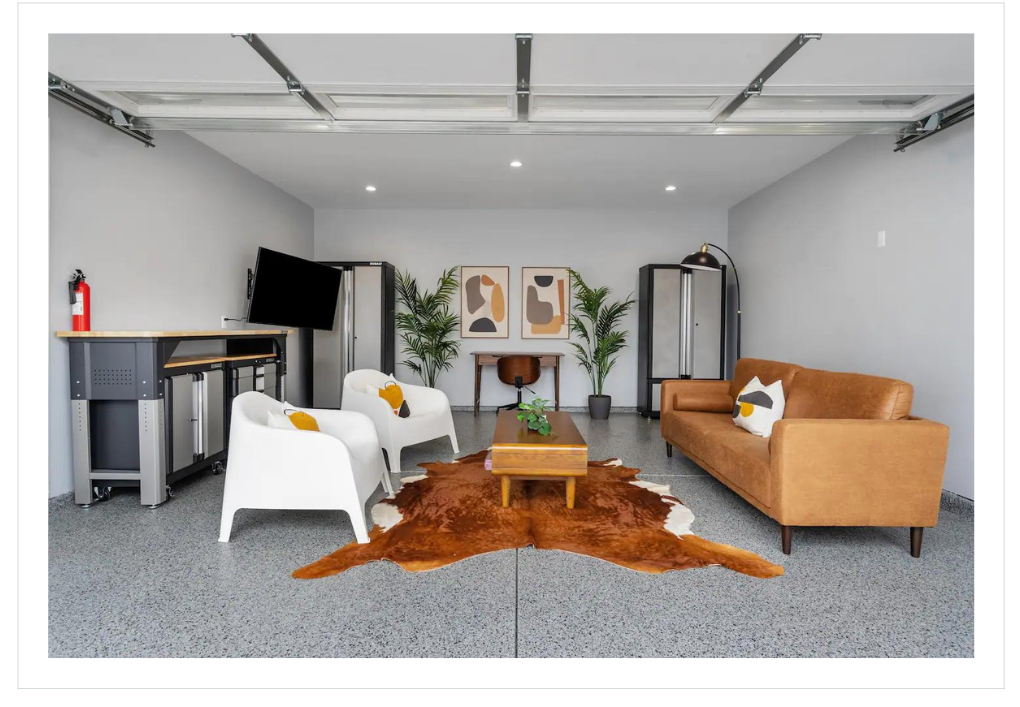

Once you’ve decided that selling your rental property is the right choice, the next step is preparing for the sale. Proper preparation can help you maximize the sale price and reduce the time your property sits on the market. Start by getting your property in tip-top shape. This may involve making necessary repairs or updates to increase the appeal to potential buyers. Consider painting, landscaping, or replacing outdated appliances to make your property stand out.

It’s also wise to get a professional property appraisal to understand the current value of your home. This will give you an idea of what price range to expect and help you set a competitive asking price. Keep in mind that the price should reflect the market conditions, your property’s condition, and any recent comparable sales in the area.

Hiring a qualified real estate agent is another crucial step in the preparation process. A skilled agent will guide you through the complexities of the selling process, from pricing to marketing to negotiations. They can also help with staging the property and advising on any improvements that will provide the best return on investment. An agent familiar with the local market can help you sell your property quickly and at the best possible price.

Lastly, be sure to have all of the necessary paperwork in order. This includes lease agreements, maintenance records, and any disclosures related to the property. Buyers will appreciate a smooth and organized transaction, which can help facilitate a quicker sale.

Timing Your Sale to Maximize Profit

While there’s no one-size-fits-all answer for the best time to sell your rental property, understanding market conditions, evaluating your personal situation, and being aware of potential pitfalls can help you make a more informed decision. In general, selling when demand is high and competition is lower can lead to the best possible outcome. If you are prepared to take advantage of favorable market conditions, manage your property effectively, and time the sale strategically, you can maximize your return on investment and achieve your financial goals.

Conclusion

Ultimately, the decision to sell your rental property is a personal one that involves balancing market factors, financial goals, and your own circumstances. Whether you’re looking to capitalize on a hot market or free up capital for other ventures, the key to a successful sale lies in careful planning and thoughtful decision-making. By understanding the risks and rewards, preparing your property for sale, and working with professionals, you can navigate the process with confidence and make the most of this significant financial opportunity.